Extreme Weather and Your Home Insurance: How to Navigate the Financial Storm

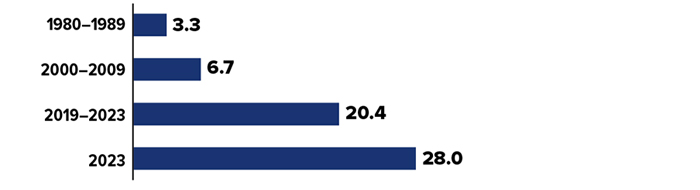

With wildfires in Maui, Hurricane Idalia in Florida, and the heat wave that blanketed the South, Midwest, and Great Plains, 2023 was a record-setting year for extreme weather in the United States. In fact, last year the U.S. saw more weather and climate-related disasters that cost over $1 billion than ever before.1

An increase in extreme weather events in recent years has caused many insurance companies to raise rates, restrict coverage, or stop selling policies in high-risk areas. This has left some homeowners in a precarious situation when it comes to insurance, as they are now faced with higher premiums, lower home values, and the possible nonrenewal of their policies.

Handling a nonrenewal

If you receive a notice of nonrenewal from your insurer, your first step should be to contact the company and ask why your policy was not renewed. They may reverse their decision if the stated reason is something you can fix — by installing a fire alarm system or fortifying a roof, for example.

If that doesn’t work, you should begin shopping for new coverage immediately. Start by contacting your insurance agent or broker or your state’s insurance department to find out which licensed insurance companies are still selling policies in your area. You might also try online tools that allow you to compare rates and coverage offered by various insurers. Finally, ask for recommendations for insurers from friends, neighbors, and coworkers who live nearby.

Average number of billion-dollar disasters per year (inflation-adjusted)

Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters, 2024

Insuring higher-risk homes

If your home is deemed to be at high risk due to its geographic area, you may want to look for an insurance company that specializes in high-risk home insurance. High-risk policies often have significant exclusions and policy limits and are more expensive than standard home insurance policies. However, they might provide coverage for a home that would otherwise be uninsurable.

If you have trouble obtaining home insurance coverage through traditional channels, you may be eligible for coverage under your state’s Fair Access to Insurance Requirements (FAIR) plan. FAIR plans are often referred to as “last resort” plans because they may be the only option available if your home is in a high-risk area. Coverage under a FAIR plan is more expensive than standard home insurance and tends to be limited; it may only provide basic dwelling coverage. In addition, most states require you to show proof that you have been denied coverage before you can apply for a FAIR plan.